Can you compete against the digital banks?

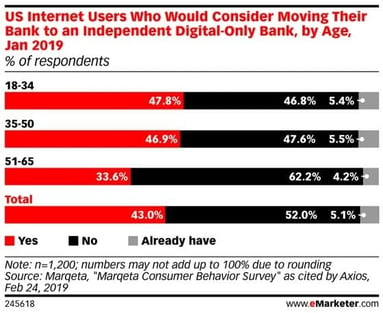

The financial industry is heavily focused on the bank of the future and one of the big concerns is a perception that consumers want an all digital solution. However, a recent study has found that only 5% of consumers have shifted to a digital only institution and more than half of US internet users would not consider moving to a digital only bank.

By now we’ve all seen the ads for Capital One’s new branch of the future with an integrated coffee shop, we know that stand alone drive through ATM’s get a lot of use (with a much lower cost than building a branch), and most consumers rely heavily on digital banking through their computers and apps.

So what do consumers want? They want it all!

So this doesn’t mean it’s time to abandon your digital efforts – you still need to keep digital banking (online and app) at the forefront for convenience and ease of access. But with that said, while most of the visits to our banking clients website include a “login” button click, we continue to see 3-5% of their pageviews on location & hours pages. Clearly there’s still a need for people to find and engage with a branch solution.

Speaking of which, don’t forget to focus on the other aspects of local search activity. Having a strong Google My Business (and other local focused services) strategy is critical to success in today’s banking environment.