Millennial opportunities for local financial services organizations

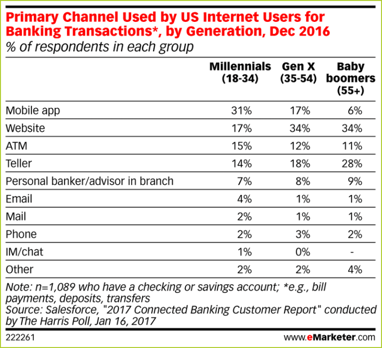

There’s a common misconception millenials don’t want or care about having a local bank…they can do everything they need online. However, the data suggests a different story. In a study released by the Harris Poll in the beginning of 2017 roughly 1/3 of Gen-Xers and Baby Boomers stated that a bank’s website was their primary channel for transactions. Yet nearly 14% of millennials still rely on a teller as their primary channel.

Millennials are mobile

Not surprisingly millennials most preferred method was mobile apps – basically swapping their preference with the Gen X audience, but we still see nearly 20% with a preference for the website.

Are tellers losing their importance?

While the data shows a very clear division in tellers as the primary channel based on generation, there’s still an important place for branches and tellers among the younger audiences. According to a study completed by ATT in April 2017, Millennials prefer local businesses:

Location, Location, Location

-

‘Staying local’ is a big motivating factor to ‘shop small’ for all respondents, with 48% saying they want to support local employment and 47% saying they want to keep money local as top reasons to shop at a small business.

-

Supporting local employment is a top motivator for millennials to shop at a small business, along with convenience.

Opportunity for regional banks/credit unions

There’s a significant opportunity for local banking to meet the needs and desires of the younger audiences. With the right marketing mix (and technology), local financial institutions are primed for growth.

Are you doing the right things to drive your business?

Request a free assessment to learn more about how you’re doing and the opportunities digital help drive your success.